Key Considerations for Employers in a Liquidity Crisis

With the recent closure of Silicon Valley Bank, employers may feel the pressure of liquidity issues, which in turn could impact their ability to pay employees on time or operate their compensation/benefits programs.

Three key considerations to focus on when evaluating your company’s internal finances are payroll, furlough, and benefits. These will effect your employees’ day-to-day lives, and eat up most of your HR staff’s time.

Payroll/Employee Communications:

Communicate immediately with employees regarding potential delays in payroll timing and provide prompt updates on changes. If you’re switching payroll to another financial institution, ensure compliance with existing wage rules that are designed to prevent changes to employee’s elected methods of payment without their consent. To the extent the employer cannot timely make payroll, consider furloughing or terminating employees.

Benefit Plans:

Review health and welfare benefit plans, contracts and arrangements to determine whether missed or late payments by the employer to third-party providers may cause a lapse in benefits/insurance coverage for employees (or otherwise impact coverage).

Fair Labor Standards Act:

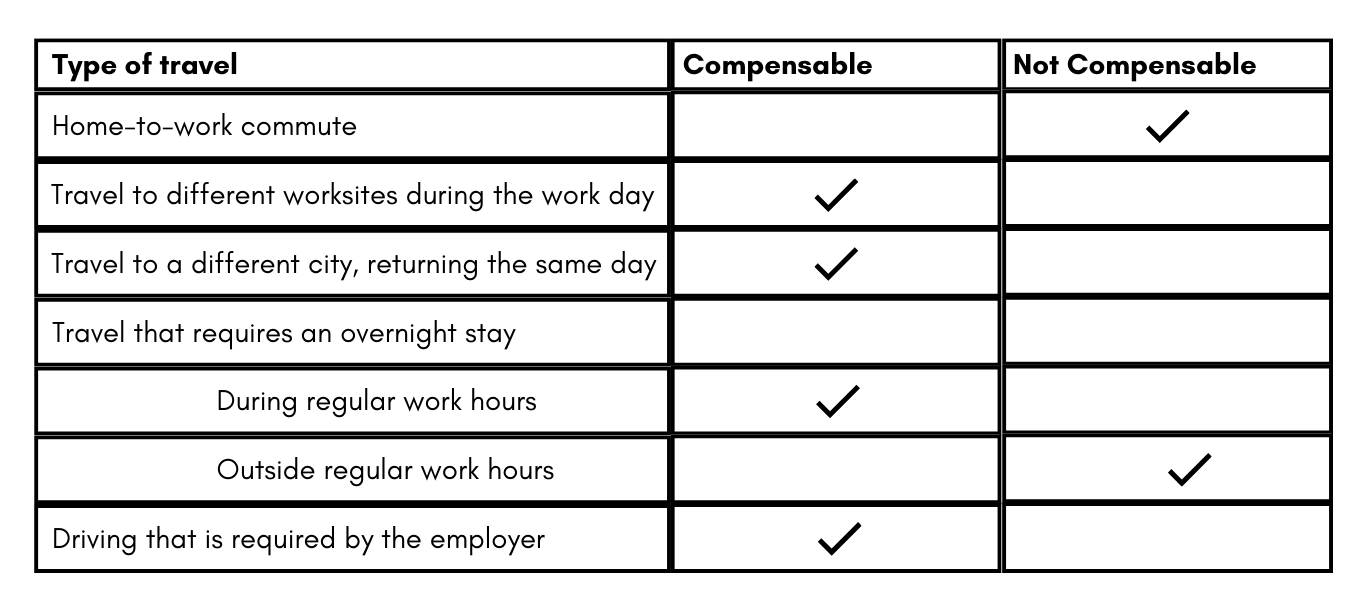

Many employers impacted by the SVB closure are faced with difficulties in making payroll. Most employers are covered by the Fair Labor Standards Act (“FLSA”), which governs federal wage and hour standards. Covered employers have several obligations under the FLSA, including ensuring nonexempt employees are paid (a) minimum wage for all hours worked and (b) overtime for all hours worked in excess of 40 hours in any workweek. There is no explicit deadline in the FLSA itself with respect to the payment of wages. Nevertheless, the U.S. Department of Labor’s (the “DOL”) position is that FLSA-mandated sums earned for a workweek generally must be paid on the regular payday for the pay period in which the workweek ends. Currently there is no available waiver, or exemption, for noncompliance resulting from bank closures.

An employer that repeatedly or willfully violates the minimum wage or overtime pay requirements of FLSA is subject to a civil penalty of up to $1,100 for each violation. For any violation (including isolated or inadvertent violations), the employer is liable to the employee for the amount of unpaid wages and overtime pay, if any, plus an equal additional amount paid as liquidated damages. There is no requirement that the affected employee show harm beyond the late payment.

In addition to potential penalties for compliance failures under FLSA, employers may also face penalties in connection with failure to timely remit the employer portion of taxes, which includes federal income tax, Social Security and Medicare taxes and Federal Unemployment Tax. There are penalties for untimely, inaccurate, or improperly paid employment taxes, imposed based on the number of days the taxes are overdue.

State Wage Laws:

In addition to complying with wage payment obligations under FLSA, employers must also comply with applicable state wage laws or risk additional fines and penalties. Unlike FLSA, many states impose specific intervals for paying employees (e.g., weekly, bi-weekly, etc.), which may vary depending on an employee’s role or function or the industry in which they work. Penalties for failing to comply with state wage laws vary by state and can include liquidated damages and attorney’s fees.

Furloughing Employees:

In connection with similar liquidity crises, employers have considered employee furloughs as an alternative to layoffs until they can resolve their liquidity issues. Furloughs generally refer to a mandatory, but temporary, cessation from work without pay, with the expectation that the impacted workforce would return to work with the employer in the future.

Health Benefits and COBRA:

Employers that sponsor group health plans should consider whether a furlough would allow employees to continue to participate in employer-provided health benefit plans as “active” participants without requiring participants to elect benefits under COBRA. The determination will depend on the terms of the applicable plan and the underlying insurance policies maintained by their plan carrier.

Qualified Defined Contribution Retirement Plans:

A furloughed employee will generally be considered an active participant in the retirement plan and will not be considered to have experienced a “severance of employment.” Therefore, the employee would not qualify to take a termination distribution from the retirement plan. Further, furloughed employees would not qualify to take a termination distribution from the retirement plan termination assessment. Furloughed employees who are considered active participants may, subject to applicable plan terms, receive plan loans (or have existing loans remain outstanding) or in-service distributions.

Other Benefits:

Employers should also carefully review and assess the impact of furloughs on company participation in, and elections made under other benefit plans, including flexible spending accounts. A furlough may be considered a qualifying event triggering an employee’s ability to make mid-year election changes under a flexible spending account.

Labor Law and Contract Considerations:

When determining which employees to furlough, it is important for employers to use objectively defined and non-discriminatory categories of employees, to mitigate arguments of disparate impact and retaliation.

Further, employers with 100 or more employees need to be aware that under the federal Worker Adjustment and Retraining Notification Act of 1988 (“WARN Act”), employers are required to provide 60 days advance written notice to terminated employees in the event of a “plant closing” or “mass layoff.”

Under the federal WARN act, notice obligations are not triggered if employees will be furloughed for fewer than six months. However, a furlough that exceeds six months or a reduction of hours by 50% for six months or more will constitute an “employment loss” and trigger WARN’s notice obligations.

Several states that have adopted “mini-WARN” laws have similar exceptions for unforeseeable business circumstances to the WARN Act, such as New York. Employers should review the applicable local, state, and federal notice requirements before furloughing any employees.

The expense of missing payroll, or letting your employee’s benefits lapse could be detrimental to your business, especially during times of economic distress. The attorneys at Wagner, Falconer and Judd have decades worth of experience navigating the ever-changing legal obligations employers face, and are only a phone call away to help you ensure your employees, and your bottom line, are protected. Visit our Support Services page to schedule a consultation with one of our attorneys.